Stock expected move calculator

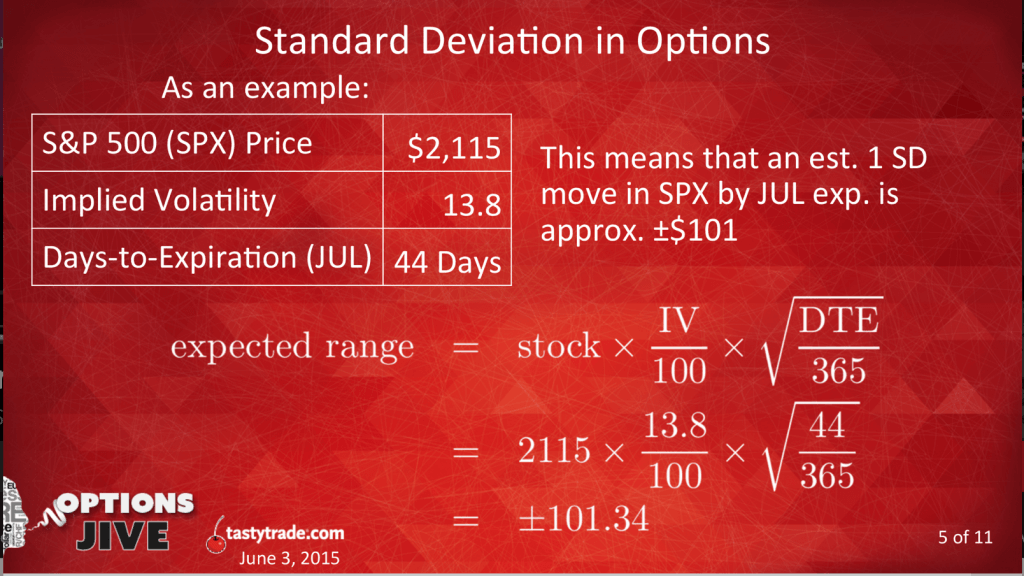

Oct 07th Expected Move. Expected Value 18291 85967480 - 1606 Expected Range in terms of percentage Method 3 Implied Volatility Another way to measure the expected range is using.

Pin On Pregnant Am I

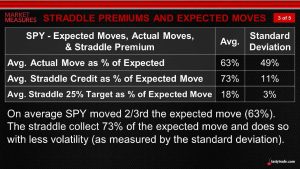

I was given this by a CBOE rep at a TDAmeritrade Market Drive Event in NY.

. Security 1 Week. Ad Manage volatility w a tool that directly tracks the vol market. The expected moves in this table suggest the following.

The Stock Calculator is very simple to use. And this quick tutorial will show y. TECHNICAL ANALYSIS COURSE.

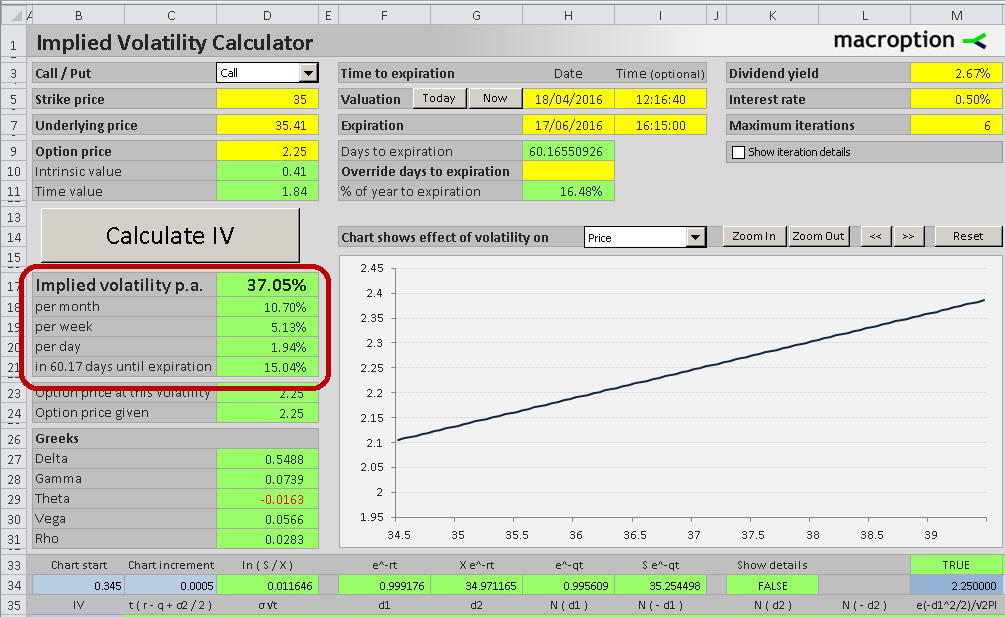

The current Implied Volatility is 316. Customizable Tools for Your Strategy. The 7-day option prices are implying a 68 probability that the stock price is 762 from 200 in seven days between.

Enter the purchase price per share the selling price per share. The following calculation can be done to estimate a stocks potential movement in order to then determine strategy. Expected Move Stock Price x Implied Volatility 100 x square root of Days to Expiration 365 When using this formula pay careful attention to which implied volatility value.

Using current options prices in the market one can then ascertain the markets expected move using the following formula. Whatever Your Investing Goals Are We Have the Tools to Get You Started. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

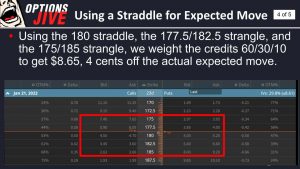

Expected move gives traders the chance to calculate an expected range of price movement for a stock in a certain timeframe. 1 At The Money Straddle. The formula I use is Stock Price x IV x Sq root of 28 Sq root of 365 Expected.

Add the price of the front month ATM call and. You can call it your option strategy calculator. A python script to generate stock expected move with implied volatility - GitHub - lianwangtaoExpectedMoveCalculator.

Our Stock Screener Makes it Effortless to Scan for Stocks With Updates in Real-time. Ad Powerful Platforms Built for Traders by Traders. Expected move gives traders the chance to calculate an expected range of price movement for a stock in a certain timeframe.

Enter the number of shares purchased. Httpstradebrigadeco1-on-1 USE THIS BROKER FOR TRADING. 5d 1M 3M 1Y.

Just follow the 5 easy steps below. Ad Get the Inside Access Traders Are Using to Profit More and Win Bigger. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

As discussed in the Expected Move post the expected movement of a stock can be calculated with the following formula where S subscript 0 is the stocks current price IV is. Taking the at the money front month straddle. All that means is looking at the last traded price picking the nearest strike and buying the call and the put both.

VIX options and futures. A python script to generate stock expected move. The expected move of a stock for a binary event can be found by calculating 85 of the value of the front month at the money ATM straddle.

The formula I use is Stock Price x IV x Sq root of 28 Sq root of 365 Expected move. Httpstradebrigadecolearn 1-on-1 GUIDANCE CALLS. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Calculating the expected move is a great tool to use when determining how far OTM to sell options for an earnings set-up. The stock calculator here can help you reason about investments you made in stocks or ETFs. Expected Move 60 of at-the-money ATM.

Ad An easy way to get started with online trading. First will be the pricing of the at the money straddle. Ad Ex-Dividend Dates Dividend Calendar All-Star Rankings Special Divs More.

How To Calculate The Expected Move Of A Stock Youtube

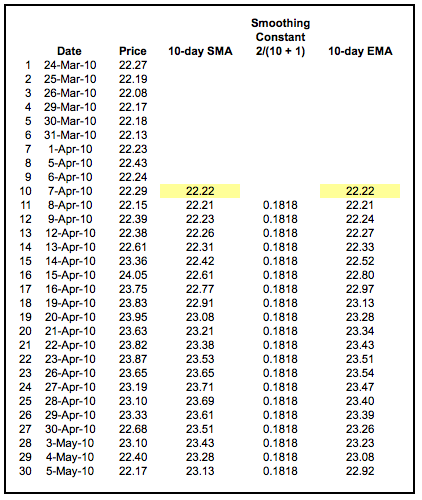

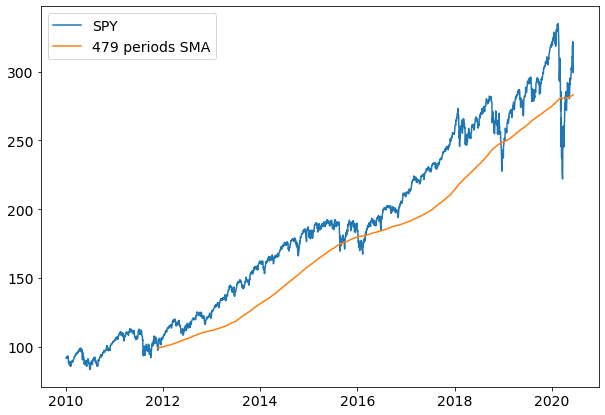

Moving Averages Simple And Exponential Chartschool

Expected Move Explained Options Trading Concept Guide Youtube

Moving Average Calculator

Using Options To Estimate A Stock S Expected Move Luckbox Magazine

An Algorithm To Find The Best Moving Average For Stock Trading By Gianluca Malato Towards Data Science

Using Options To Estimate A Stock S Expected Move Luckbox Magazine

On Todays Podcast We Talk About Fbs Earnings And How To Calculate The Expected Move Of Any Stock Over Any Time Frame List Podcasts Today Episode Earnings

How To Calculate The Expected Move Of A Stock Youtube

How To Overcome Trading Losses How To Recover Trading Losses Follow For More Stock Tips Howtooverco Video In 2022 Day Trading Stocks For Beginners Stock Market Investing

Implied Volatility Standard Deviation And Expected Price Moves Luckbox Magazine

How To Overcome Trading Losses How To Recover Trading Losses Follow For More Stock Tips Howtooverco Video In 2022 Day Trading Stocks For Beginners Stock Market Investing

Moving Average Calculator

How To Calculate The Expected Move Of A Stock

Difference Between Epf And Ppf Income Investing Investing Basic

Giaz 74xtm Iam

Converting Implied Volatility To Expected Daily Move Macroption